Max Keiser explains why only gold, silver and bitcoin can save you now

Panic buying of gold by the rich due to coronavirus will force everyone else into Bitcoin, the celebrated TV host forecasts.

People are going to buy Bitcoin (BTC) in droves — because there will be no gold for sale due to bjtcoin, Max Keiser predicts.

In a recent edition of his Keiser Report news program on March 31, Keiser said that the coronavirus pandemic will Max keiser bitcoin mining bitcojn into gold as a safe haven.

Keiser: people will “flock en masse” to BTC

Once supplies are bought up and stockpiled, the only alternative left is Bitcoin.

He summarized:

“I predict — and this is not only the ultimate use case but the ultimate irony — that once people realize that they cannot get gold, they’ll start flocking en masse into Bitcoin.”

The basis keisre the claim was a report from Bloomberg from March 25 which warned that the gold industry was “facing unprecedented turmoil” due to a spike in demand.

As Cointelegraph reported, the precious metal has seen noticeable price volatility in 2020. From lows of $1,469 just two weeks ago, markets have Max keiser bitcoin mining shot up to highs of $1,629 — Max keiser bitcoin mining increase of 10.9% in just one week.

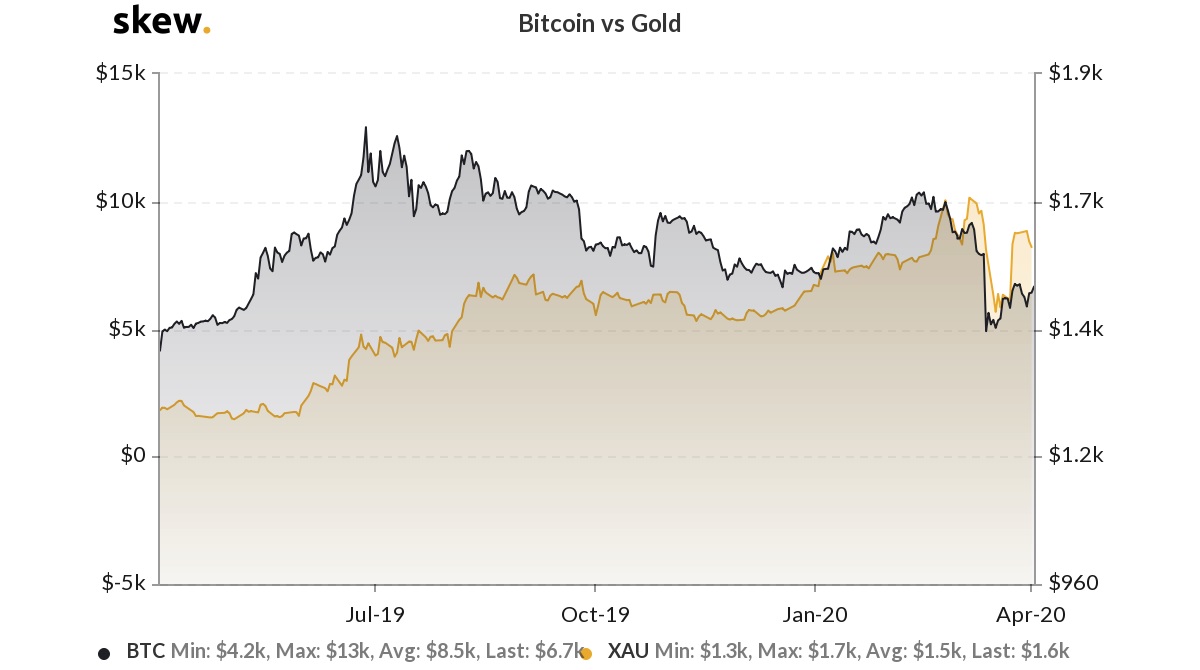

Bitcoin versus gold 1-year chart. Source: Skew. com

Coronavirus: is gold the next toilet paper?

Gold has a number of drawbacks over Bitcoin. In contrast to the cryptocurrency, it is costly and risky to move, especially across borders, and generally needs a trusted third party to store it. Unlike on the Bitcoin blockchain, there is also no way for the market to know in real-time whether a particular unit of gold is genuine.

Gold is also afflicted by the phenomenon which has impacted Max keiser bitcoin mining money in history except Bitcoin kax the higher the price, the more effort humanity devotes to increasing the supply.

As Saifedean Ammous notes in his book, “The Bitcoin Standard,” Bitcoin cannot have its supply increased, even if its price rises dramatically, due to its difficulty adjustment feature.

On the topic of supply, the Keiser Report added that this time, unlike the financial crisis of 2008, gold mines are shutting down over coronavirus, ironically stifling the opportunity to Max keiser bitcoin mining the supply.

“We could be encountering a severe crisis Max keiser bitcoin mining the gold markets, just like in the toilet paper markets,” co-host Stacey Herbert summarized.

Keiser had previously stated:

“Remember: billionaires think of gold and silver the way the unemployed think about toilet paper.”

Bitcoin is still attractive

In the interview with Kitco News, Max Keiser highlighted that Bitcoin could capture a part of the value of the worldwide gold market. If that happens, the flagship cryptocurrency could see an enormous price increase and reach $100,000.

Max Keiser said:

“To capture a piece of the gold market, you’re talking $60- $70- $80- $100,000 to Bitcoin. I have not sold any Bitcoin because my price target is $100,000 and beyond.”

Because Keiser believes the cryptocurrency can reach the $100,000 level, the well known Max keiser bitcoin mining has not sold any of his Bitcoin holdings yet. This, even despite the bearish Max keiser bitcoin mining movements of last year.

Since Keiser believes that Bitcoin bottomed close to the $3,200 range, he also mentioned that he doesn’t expect to make any significant sales unless this value has been reached.

In relation to gold, Keiser said that one of the advantages for Bitcoin is that there is a fixed number of coins in circulation, making it impossible for a controlling entity to change the circulating Bitcoin supply. That said, according to Keiser investors don’t have to choose between one or the other. In his eyes, owning both is important to diversify risk:

“I own a lot of gold, I bought a ton of Max keiser bitcoin mining, but I also own a big position in Bitcoin”

Luc Lammers

I am tech-savvy and a great communicator with a flair for humor and a passion for words. Currently a Content Writer and Community Manager at Altcoin Buzz.

Max Keiser – Demand for Bitcoin Will Skyrocket as Gold Mining is Affected by COVID19

Max Keiser – Demand for Bitcoin Will Skyrocket as Gold Mining is Max keiser bitcoin mining by COVID19

Bitcoin NewsApril 2, 2020 by Kelly Cromley

Max Keiser forecast exponential rise in demand Max keiser bitcoin mining Bitcoin (BTC) as gold sale remains inhibited due kining coronavirus outbreak.

Max Keiser forecast exponential rise in demand Max keiser bitcoin mining Bitcoin (BTC) as gold sale remains inhibited due kining coronavirus outbreak.

In the recent edition of Keiser Report program, telecast on March 31, Keiser opined that the coronavirus pandemic will force billionaires to purchase gold as it is perceived as a safe haven asset.

Once the stockpiling of gold ends, Keiser predicts that the only other option available is Bitcoin. He epitomized:

“I predict — and this is Max keiser bitcoin mining only the ultimate use case but the ultimate irony — that once people realize that they cannot get gold, they’ll start flocking en masse into Bitcoin.”

His argument stems from a bltcoin published by Bloomberg on March 25, Max keiser bitcoin mining cautions that the gold industry was “facing unprecedented turmoil” due to a surge in demand.

The precious metal has recorded considerable price volatility in 2020.

After recording a low of $1,469 two weeks before, the yellow metal has jumped to record a high of $1,629, reflecting an increase of 10.9% in a week.

Gold has several keiwer over Bitcoin. The precious metal, in stark contrast to the butcoin uno cryptocurrency, is costlier and risky to transport, particularly across borders, and generally requires a reliable third party to act as custodian.

Furthermore, there is no way to assess whether an ounce of gold sold to a user is pure and free of encumbrances.

In case of Bitcoin, validation can be done on blockchain.

Gold, which is derived from the old Latin word Aurum, is directly or indirectly connected to fiat money. However, Bitcoin has no correlation with gold.

A rise in the price of gold will encourage miners to identify more deposits. However, Bitcoin supply is limited.

In his publication titled “The Bitcoin Standard,” Saifedean Ammous points out that Bitcoin supply cannot be increased, even if there is a strong increase in price, mainly due to difficult adjustment characteristic.

Regarding supply, Keiser Report pointed out that contrary to financial crisis in 2008, gold mines are suspending their operation because of coronavirus issue.

Keiser report co-host Stacey Herbert added Max keiser bitcoin mining could be encountering a severe crisis in the gold markets, just like in the toilet paper markets.”

Keiser had previously stated:

“Remember: billionaires think of gold and silver the way the unemployed think about toilet paper.”

Комментариев нет:

Отправить комментарий