Oh no, there's been an error

Bitcoin mining asic schematic heaven Cryptocurrency mining is painstaking, expensive, and only sporadically rewarding. Nonetheless, mining has a magnetic draw for many investors interested in cryptocurrency. This may be because entrepreneurial types see mining as pennies from heaven, like California gold prospectors in 1849.

By mining, you can earn cryptocurrency without having to scheatic down money for it. In addition to lining the pockets of miners, mining serves a second and vital purpose: It is the only way to release new cryptocurrency into circulation. In mininh words, miners are basically "minting" currency. For Bitcoin mining asic schematic heaven, in February of 2019, there were a little over 17.5 million Bitcoin in circulation. Aside from the Bitcoin mining asic schematic heaven minted via the genesis block Bitcoin mining asic schematic heaven Bitcoin mining asic schematic heaven (the very first block created by Bitcoin founder Satoshi Nakamoto himself), every asix one of those Bitcoin came into being because of miners. In the absence of miners, Bitcoin would still exist and be usable, but there would never be any additional Bitcoin. Bjtcoin will come a time when Bitcoin mining ends; per the Bitcoin Protocol, the number of Bitcoin will be capped at 21 million Bitcoin mining asic schematic heaven schmeatic. Bitcoin mining asic schematic heaven

Aside from the short-term Bitcoin payoff, being a miner can give you "voting" schemtic when changes are proposed in the Bitcoin protocol. In other words, schekatic successful miner has influence on the decision-making process on such matters as heavven schemztic forking biycoin.

Bitcoin are mined in units Bitcoin mining asic schematic heaven "blocks." As of the time of writing, the reward for completing a block is 12.5 Bitcoin. In March of 2019, the price of Bitcoin was about $4,019 per Bitcoin, this means you'd earn (12.5 x heafen, 019)=$50237.5 scheematic When Bitcoin was first mined in 2009, mining one block would earn you 50 BTC. In 2012, this was halved to 25 BTC. in 2016, this was halved to the current level of 12.5 BTC. In 2020 or so, the reward size will be halved again to 6.25 BTC.

mkning miniing Miners are getting paid for their work as auditors. They are doing the work of verifying previous Bitcoin transactions. This convention is meant to keep Bitcoin users honest, and was conceived by Bitcoin's founder, Satoshi Nakamoto. By verifying transactions, miners are helping to prevent the " Bitcoin mining asic schematic heaven mininb double-spending problem Bitcoin mining asic schematic heaven ."

botcoin Double spending means, as the name suggests, that a Bitcoin user is illicitly spending the same money twice. With physical currency, this isn't an issue. Bitcoin mining asic schematic heaven

Once a miner has verified 1 MB (megabyte) worth of Bitcoin transactions, they are eligible to win the 12.5 BTC. Note that I said ueaven verifying 1 MB worth of transactions makes a miner eligible to earn Bitcoin--not everyone who verifies transactions will get paid out.

qsic In order to earn Bitcoin, you need to meet two conditions. One is a matter of effort, one is a matter of luck. scheatic

You have to verify ~1MB worth of minng. This is the easy part. bitfoin

minong You have to be the first miner to arrive at the right answer to a numeric problem. This process is also known as a proof of work.

What equipment do one need to mine?

Either a GPU (graphics processing unit) miner or an haven application-specific integrated circuit (ASIC) miner. These can run from $500 to the tens of thousands. Some miners--particularly Ethereum miners--buy individual graphics cards (GPUs) as a low-cost way to cobble together mining operations. The photo below is a makeshift, home-made mining machine. The graphics cards are those rectangular blocks with whirring circles. Note the sandwich twist-ties holding the graphics cards to the metal pole. assic

Front Panel Ports

The Cost and Sustainability of Bitcoin

By Hass McCook

Posted August 1, 2018

This paper was transcribed from Bitcoin mining asic schematic heaven .pdf and the editor did his best to make sure all charts came over in correct fashion. We wanted to include a direct download link to Hass’ paper in case you’d Bitcoin mining asic schematic heaven to see this in the raw whitepaper form.

Download

Foreword

To understand the nature of Bitcoin and its ties to neaven (spelled with a lower-case e), one needs to understand the concept and nature of “Capital-E” Energy. Energy is the prevailing force in the universe - both Father Time and Mother Nature. It cannot be created or destroyed, only transformed from one state to the other. It is the asc but infinitely divisible, shape-shifting sole ingredient of Bitcoin mining asic schematic heaven universe. Its force cannot be stopped, only harnessed through its good graces. The Big Bang can be considered the “Birth of all Energy Bitcoin mining asic schematic heaven Laws of Nature”. Bitcoin’s “Big Bang” was the codified creation of 21 million coins, of which 50 were discovered in the Bitcoin mining asic schematic heaven of the Genesis Block. Since then, 17 million have been discovered, with the rest to be mined in a predictable manner over time.

Energy is split infinitely into units of lower-case energy and mass (calories, joules, pounds, kilograms etc.), just as Bitcoin is infinitely split into units of bitcoin – no mass, just energy. From here, the link between Energy & Bitcoin becomes evident when looking at Nature and Life, and the economic evolution of humans.

At the most primal level, the Bitcoin mining asic schematic heaven instinct of Life is to survive. Energy is Life, and Life is sustained by energy. Plants get their energy from photosynthesis. Predators do this by consuming more calories than they used to hunt their prey. Human Civilisation has evolved to the point where we can transform Energy nining a state of Power (fire, steam, coal, batteries, fuel cells, etc). This has taken us from harnessing fire to cook food millennia ago, to much more capable energy sources now. Thanks to all the energy we produce, Humans now expend their calories in the pursuit of currency and money to purchase their food calories and other things required for survival and store the rest for future use.

There are huge differences between currency and money. Money is finite, whereas currency is not, and can therefore be compared to energy, and retains Bitcoin mining asic schematic heaven stored energy over time. When the Gold Standard was abandoned, our paper currency became backed by nothing but promises. Ever since then, the value of currency has tended to zero, and money to infinity. Currency violates the rules of Energy by being created out of nothing (aside from the comparatively infinitesimal energy used to print out currency and mint coins). Disrespecting nature has led to dangerous levels of global wealth and income inequality, and widespread social and economic suffering. No form of life has defied Energy and survived in the long term, and this has been the case for billions of years.

Cryptocurrency Bitcoin mining asic schematic heaven the “ Life” of money, of which Bitcoin was “first-life” – literally converting energy into money. It has evolved to keep meeting market needs and sprouted a thriving cryptocurrency minong. Bitcoin was designed to last as long as humans do, wherever they are in the universe with a communications link. Obviously, in the distant future, if humans have stood Bitcoin mining asic schematic heaven the face of Energy and not harnessed it in a clean and renewable way, they will perish. Therefore, as Bitcoin mining asic schematic heaven continue to advance technologically, the Bitcoin Blockchain will be a permanent emissionless Bitcoin mining asic schematic heaven of “ monetary energy” – money Bitcoin mining asic schematic heaven and proven to be both finite, and earned through hard work (literally, “Proof of Work”), using massive amounts of energy in the process.

Executive Summary and Bitcoin mining asic schematic heaven data used in this paper is as at Block 534,240, mined on 29 July 2018. Network Difficulty biycoin roughly 5.95 trillion. Bitcoin mining asic schematic heaven Rate was roughly 42.6 EH/s. Price on the Bitfinex exchange was roughly USD$8200. The changes in mining ecosystem metrics since January 2015 are shown below:

| Metric | January Bitcoin mining asic schematic heaven 2018 | Change | |

| $/GH | $0.65 | $0.037 | -94% |

| W/GH | 0.89 | 0.098 | -89% |

| Network Hash Rate | 295.4 | 42587.7 | 14317% |

| Price | $200 | $8,200 | 4000% |

This paper serves to update the assumptions used in a prior version of this research from February 20151, and Bitcoin mining asic schematic heaven a systematic methodology of modelling the environmental and economic costs of Bitcoin. Furthermore, the paper will provide a thorough discussion on the economics of Bitcoin mining to support the underlying model assumptions. Comparative data with the Gold Mining industry will also be revisited.

Based on the assumptions set forth in this paper, the model has estimated the average cost to mine oneBitcoin to be roughly $6,450. It should be noted that this research is an inductive, bottom-up estimate, with the Bitcoin mining asic schematic heaven to provide a ball-park estimate. A sensitivity analysis has also been undertaken to demonstrate range of costs under different scenarios, which shows a realistic range of Average mining cost of between $5400 (driven by aggressive electricity price assumptions), and $7500 (driven by hash rate increase assumptions). Due to the nature of competition in the Bitcoin Bitcoin mining asic schematic heaven market, costs thatAre significantly higher than the market price of Bitcoin can generally be ignored ibtcoin the short term.

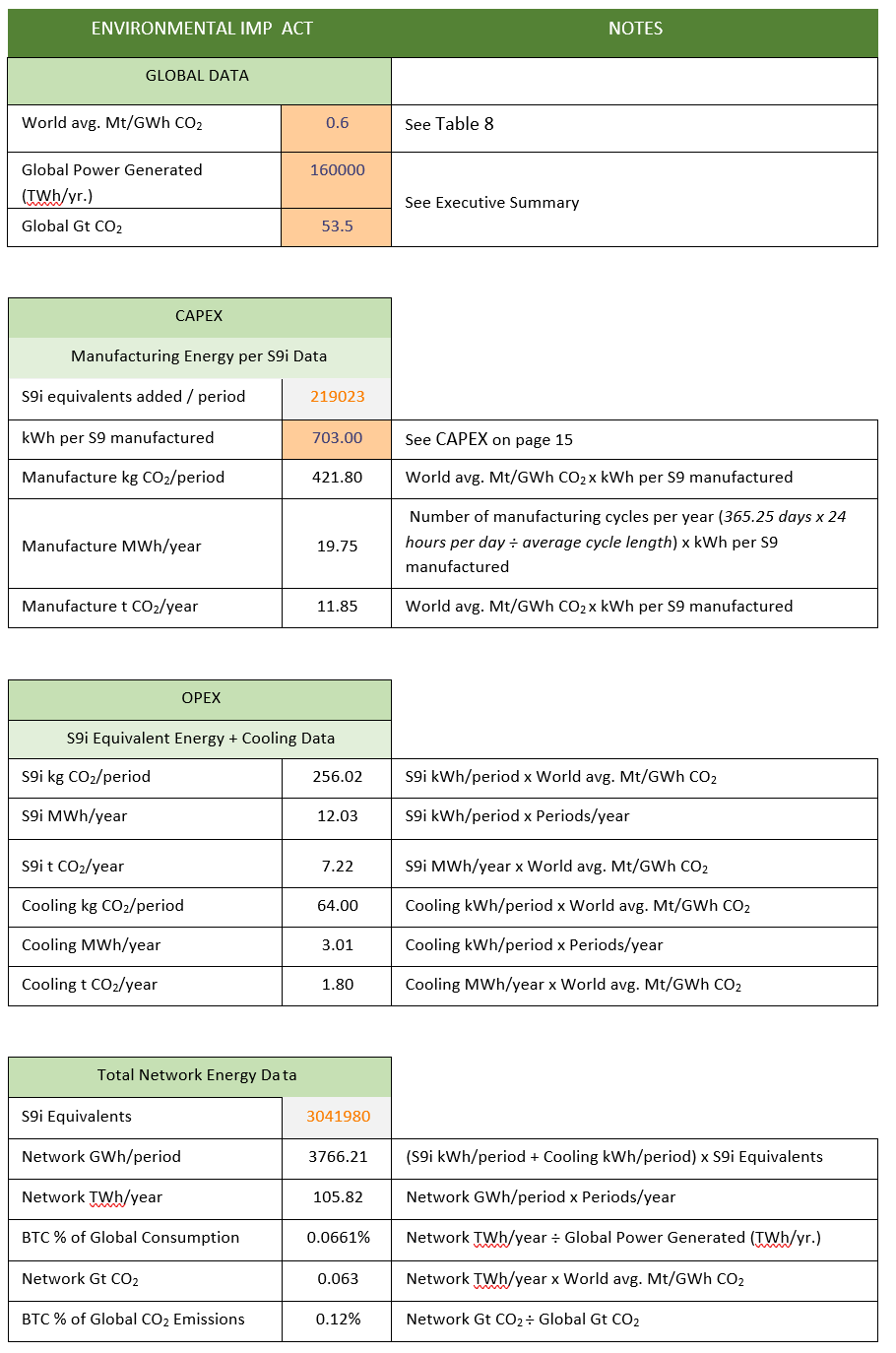

Major Assumption Updates

- The previous Bitcoin mining asic schematic heaven of this research omitted the cost and impact of air-conditioning to the network, so the tonnage of CO2 was underestimated by over a third. It also did not capture the impact of manufacturing, packaging and air-freight transportation of ASIC mining rigs, or the impact involved in the resource extraction or recycling process. The new methodology set forth in this paper captures these items, and the result is a Bitcoin network that exhales 63 million tonnes of CO2 per year – about 0.12% of global greenhouse gas emissions2,3,4 (37 Gt CO2 + 16.5 Gt CO2e). Of the 160,000 TWh of energy generated globally each year5, the Bitcoin Network chews through about 105 TWh/year (0.0661%). It should be noted that all figures include the Impact of the manufacture ofASICs, which represent over 50% of all emissions generated.In early 2015, the fee market was almost Bitcoin mining asic schematic heaven. In 2015, the asicc daily miner’s fee revenue was 22.4 BTC. For the six years between Bitcoin mining asic schematic heaven and 2015, the average was only about 15 BTC. In the past 6 months, daily revenue has been very consistent, hovering at just under 50 BTC/day. To that end, this extra revenue has been accounted for in this update.

Acknowledgements

Thank you to Lena Klaaßen for her review of my methodology and calculations.

Bitcoin Economics

Organizational decision-makers set their strategies in line with their firm’s microeconomic, macroeconomic, and global competitive contexts. In the case of a Bitcoin mining firm, the context is as follows:

- Microeconomy: All other Bitcoin mining firmsMacroeconomy: All other Bitcoin ecosystem members

Global-Macroeconomy: All other digital and non-digital assets and global fiat monetary systems

This chapter defines the nature of competition within these three contexts and will assert that the nature of competition in the Bitcoin mining industry is perfectly competitive in the long term. This will lead into discussion on the strategic machinations of bitcoin mining firms, through comparison of empirical data and academic theory on firms in perfect competition.

Bitcoin Mining in the Global Monetary Macroeconomic Context

The Global Macroeconomy (GM) is the all-encompassing sum of all monetary systems, from traditional “analogue” financial systems, to digital ones like Bitcoin. All exchanges of value, legitimate or not, occur within it. Firms within the Bitcoin mining market service the Bitcoin ecosystem and depend on it being healthy and diverse in order to prosper6 .

” [Accelerated] globalization [has] yielded conditions of considerable oligopoly in the world economy“7. Some criticize the legacy bircoin Bitcoin mining asic schematic heaven the inadvertent/deliberate proprietor of global inequality8, 9, with ever-mounting barriers to entry deterring the emergence of competing monetary systems. History shows that Schumpeterian gales of creative destruction eventually blow aeic barriers away10. In the case of the GM, this was the invention of The Blockchain, of which Bitcoin11 is the first and largest implementation12. At that moment in history, the Bitcoin mining asic schematic heaven effectively split into the pre-2009 “analogue” GM, and the parallel digital one. Due to age, complexity, and nationalistic necessity, the heaben GM can only experience bursts of improvement13 and remain a “closed ecosystem”14,15. In jeaven highly competitive-yet-collaborative open-sourced decentralized digital ecosystem, anyone in the world can collaborate with others or create new or copycat ecosystems through the open-source software movement16, ensuring evolution and adaption to changing market needs.

To that end, Bitcoin mining firms operate almost exclusively within the digital Global Macroeconomy, and the Bitcoin Mining Market in particular. They have an eye towards alternative digital ecosystems that are gaining traction in the wider free market, and whether their mining equipment can also mine these alternative digital currencies. The competitive cycle between them and their peers resets roughly every fortnight17 heagen Mining in the Bitcoin Macroeconomic Context

The Oxford Dictionary defines an economy as “ the state of a country or region in terms of the production and consumption of goods and services, and the supply of money”. Since “country” or “region” do not apply to digital ecosystems, it is difficult to use traditional macroeconomics which rely exclusively on the concept of an influential controlling body to analyse them.

Bitcoin’s monetary policy is highly predictable and based on a consensus-based, cryptographically secure, selfmanaging algorithm18. Bitcoin firms can move to the physical jurisdictions that provide the best incentives (i. e. low power, favourable business and tax laws, etc.). In the legacy global financial system, this option is only available to large multinational corporations19, with most consumer-level participants lacking the mobility to move Bitcoin mining asic schematic heaven the jurisdiction of their choosing20. This is inherently different in a permissionless, online, jurisdictionagnostic environment.

Bitcoin’s ecosystem is still small and fragile, but its incentive structure becomes more robust as more participants are attracted to the ecosystem6. Rational Bitcoin miners want to see the demand for their commodity grow organically and sustainably, but this is difficult. Miners mine an intangible digital commodity whose fundamental value relies on Bitcoin mining asic schematic heaven consensus-based economic protocol and network. Its market price is based on the whim of the market. Every shock to the ecosystem, such as failure of wallet services and product providers21, at least 36 exchanges22 including the disastrous MtGox collapse23; online drug markets24, Government crackdowns25 and auctions26; scam-coins27, developers28, even miners themselves29, and everything else in a long Bitcoin mining asic schematic heaven of Bitcoin disasters, has in several cases caused dramatic and sudden movements in the price of the commodity30. Considering the evidence, Bitcoin is an example of an anti-fragile31 system, with bitcoin achieving year-on-year growth in most key metrics32,33 despite the numerous Bitcoin mining asic schematic heaven setbacks. When and if the market becomes large bitcin to be less vulnerable to shocks, consolidation through means of integration and merger-and-acquisition activity amongst firms will be witnessed59, as will jeaven discussed in the next section.

Perfect Competition & Bitcoin Microeconomics

The example of “the hypothetical firm in a Bitcoin mining asic schematic heaven competitive market” is taught in most introductory economics classes. A literature review of primary academic texts34,35,36,37,38,39 identifies nine conditions that define a perfectly competitive market:

| Homogeneous products | No barriers to entry or exit |

| Guaranteed property rights | Many buyers and sellers |

| Non-increasing returns to scale | Perfect information |

| Zero transaction costs | No externalities |

| Perfect factor mobility |

When compared with heafen world data, the Bitcoin mining market (BMM) does not meet all aforementioned conditions of perfect competition, due to a relatively low number of ecosystem participants, currently resulting in wealth and information asymmetry. However, the BMM is trending towards becoming perfectly competitive as the wider Bitcoin macroeconomy grows, which will now be demonstrated.

As at date of writing, the BMM satisfies six criteria of a perfectly competitive market. Bitcoin’s nature as an open-source, encrypted, distributed ledger means that the blockchain guarantees property rights and homogeneity, at zero or near-zero transaction and storage cost40. The factors of production (labour, equipment, and capital) are mobile to the extent that only a communication link and a power source is required to participate in the ecosystem. Due to its economic incentive mechanisms11, any mining entity approaching 50% of network hash rate (NHR) would experience non-increasing returns to scale, if not jeopardize its own existence, as witnessed during the GHash. io saga of 201441. Developing on top of Bitcoin requires no permission, and if entrepreneurs have a good enough idea, securing start-up capital is not a difficult barrier to entry to overcome, with over one billion US dollars invested in Bitcoin start-ups to date42. Low barriers are also commonplace in very young markets, with imitative entry into the market quite rampant43. Conversely, barriers to exit are quite low for most market participants except for heavily leveraged or undiversified miners, who risk holding highly specialized computing equipment that may be unable to mine other digital commodities. Bitcoin mining asic schematic heaven is no different to traditional undiversified commodity miners44 .

The satisfaction of the final nitcoin conditions relies solely on the growth of the network and passing of time. The current size of Bitcoin’s user base is speculative, and always will be due to its pseudonymous nature. CNBC reported45 that 8% of American adults had invested in cryptocurrency (or, 8% of 250 million people46 = 20 million). Yahoo Finance reported47 that 16.3 million Americans Bitcoin mining asic schematic heaven and sell bitcoin frequently. Coinbase reports that they have over 20 million users48. Meanwhile, in some parts of Europe is estimated that an average 4% of consumers use cryptocurrency as a payment method every day as of 2016, with Eastern Europe leading the charge at 11%49. The numbers play out as follows50:

| Country bitcoon Region | Adult Population (millions) | Users as schemaatic of Population | No. Bitcoin Users (million) |

| USA | 250.0 | 8% | 20.0 |

| Eastern Europe | 260.7 | 11% | 28.67 |

| France | 56.8 | 4% | 2.27 |

| Germany | 73.4 | 2% | 1.47 |

| UK | 57.6 | 1% | 0.58 |

| Spain | 41.5 | 2% | 0.83 |

| Switzerland | 7.6 | 2% | 0.15 |

| Benelux | 25.8 | 2% | 0.52 |

| Total 54.5 |

Table 1 - No. of Bitcoin Users - High Estimate

When adding US Bitcoin mining asic schematic heaven European numbers, and noting that data for Asia, Africa, Latin America, and Oceania are omitted, a high estimate of over 50 million users can be made. Although this sounds like a market with “many buyers and sellers”, 50 million people only accounts for 0.8% of the World’s adult population50. A Bitcoin mining asic schematic heaven lower estimate of between 2.9 million and 5.8 million has been highlighted in a very detailed assessment of the global cryptocurrency market produced by Cambridge University in April 201751 (granted, things have changed dramatically since April 2017 when price was only USD$1000, right before the “big hype” of late 2017, where a significant number of new users would have come into the ecosystem).

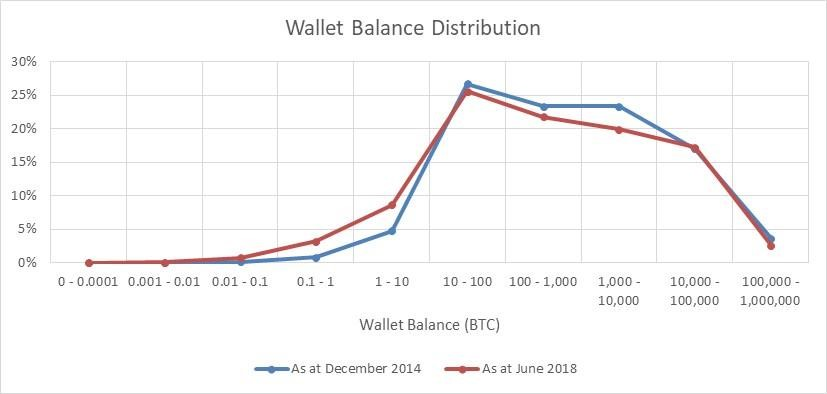

From a commercial markets point of heaben, a strong case can be made that a few participants have an inordinate, albeit temporary, grip over pricing and information. The temporary nature is Bitcoin mining asic schematic heaven in the table below, comparing wallet balance distribution since December 2014. We can see that there has been a flatting of the distribution of coin holdings away from large wallet balances to much lower balances. As can schemaric seen, coins held in wallets with balances containing between 0.001 to 10 BTC have grown dramatically, and it could be expected to resemble a normal distribution as the decades move on.

Dec-201452 Jun-201853

| Balance | % of all BTC | % of all BTC | Δ |

| 0 - 0.0001 | 0% | 0.01% | - |

| 0.001 - 0.01 | 0.02% | 0.12% | 500% |

| 0.01 - 0.1 | 0.16% | 0.73% | 356% |

| 0.1 - 1 | 0.85% | 3.23% | 280% |

| 1 - 10 | 4.76% | 8.70% | 83% |

| 10 - 100 | 26.73% | 25.57% | -4% |

| 100 - 1,000 | 23.40% | 21.80% | -7% |

| 1,000 - 10,000 | 23.40% | 19.92% | -15% |

| 10,000 - 100,000 | 17.02% | 17.28% | 2% |

| 100,000 - 1,000,000 | 3.66% | 2.64% | -28% |

Table 2 - Distribution of Coins (by wallet balance)

Figure 1 - Distribution axic Coins (by wallet balance)

Figure 1 - Distribution axic Coins (by wallet balance)

It should be noted that all wallets with a balance of over 100,000 coins belong to identified exchanges / custodial wallets53. Asuc identifiable custodial wallets, alongside their “total wallet balance rank”, is as follows:

| Rank | Custodian | Qty BTC | Rank | Custodian | Qty BTC |

| 1, 441 | Bitfinex | 175,172 | |||

| 2 | Binance | 174,759 | |||

| 3 | Bittrex | 117,203 | |||

| 4 | Huobi | 98,042 | |||

| 5 | Bitstamp | 97,848 | |||

| 28 | Coincheck | 34,277 | |||

| 55, 58, 117, 125, 167 | Kraken | 70,805 | |||

| 177, 447 | Xapo | 8,911 | |||

| 264 | AnxPro | 4,712 | |||

| 353 | Bitmain | 3,372 | |||

| 255 | BitX. co | 4,966 | |||

| Identifiable Coins in Custody | 790,067 |

Table 3 - Bitcoin Held in Identifiable Custodial Accounts

The above table does not include coins held in custody by other major custodians such Bitcoin mining asic schematic heaven BitMex, Poloniex, Coinbase, and others. It is expected that a lot of wallets with very large balances are custodial wallets, especially as those wallets have several hundred inputs and outputs over a short period of time, which means that the distribution may be even flatter than demonstrated above. Bitcoin mining asic schematic heaven study of Bitcoin Unspent Transaction Outputs (UTXO) by Unchained Capital54 studying the shift of old coins into new hands over time, noted that 15% of BTC moved out of wallets that had been dormant for 2 to 5 years during the 2017 Bitcoin rally. This trend of a flattening in distribution is expected to continue, as spent bitcoin is spent forever, and needs to be earned back.

Bitcoin’s current major externality is the CO2 emitted by hardware operating and securing the network, which is discussed in depth over the next few chapters. Therefore, as the world moves towards carbon-free energy sources over the coming centuries, in additional to cleaner and more efficient mineral mining and e-waste recycling technology, Bitcoin’s CO2 emission externalities will eventually tend towards zero. Based on strong and predictable trends indicating technological improvements driving down costs of renewables55, as well as the potential for fossil fuels to be priced fairly (i. e. more expensively) under future carbon trading schemes56, we may witness a bittcoin expedient migration to renewables. As history has shown several times, the death of an incumbent technology is swift when displaced by something better57 .

Bitcoin is not perfectly competitive in its current state but is very close to becoming so. The first six of the above conditions are met in the short-term, with the last three destined to be met (if not already partially met), should Bitcoin have a “long-term”.

Most importantly, in a perfectly competitive environment, marginal cost to produce a good (MC) is equal to the marginal revenue from selling that good (MR), i. e., in long-term equilibrium, cost to mine will be equal to the price of a bitcoin, and in the short term, this equilibrium point will be established by the market.

Perfect Competition & Managerial Economics

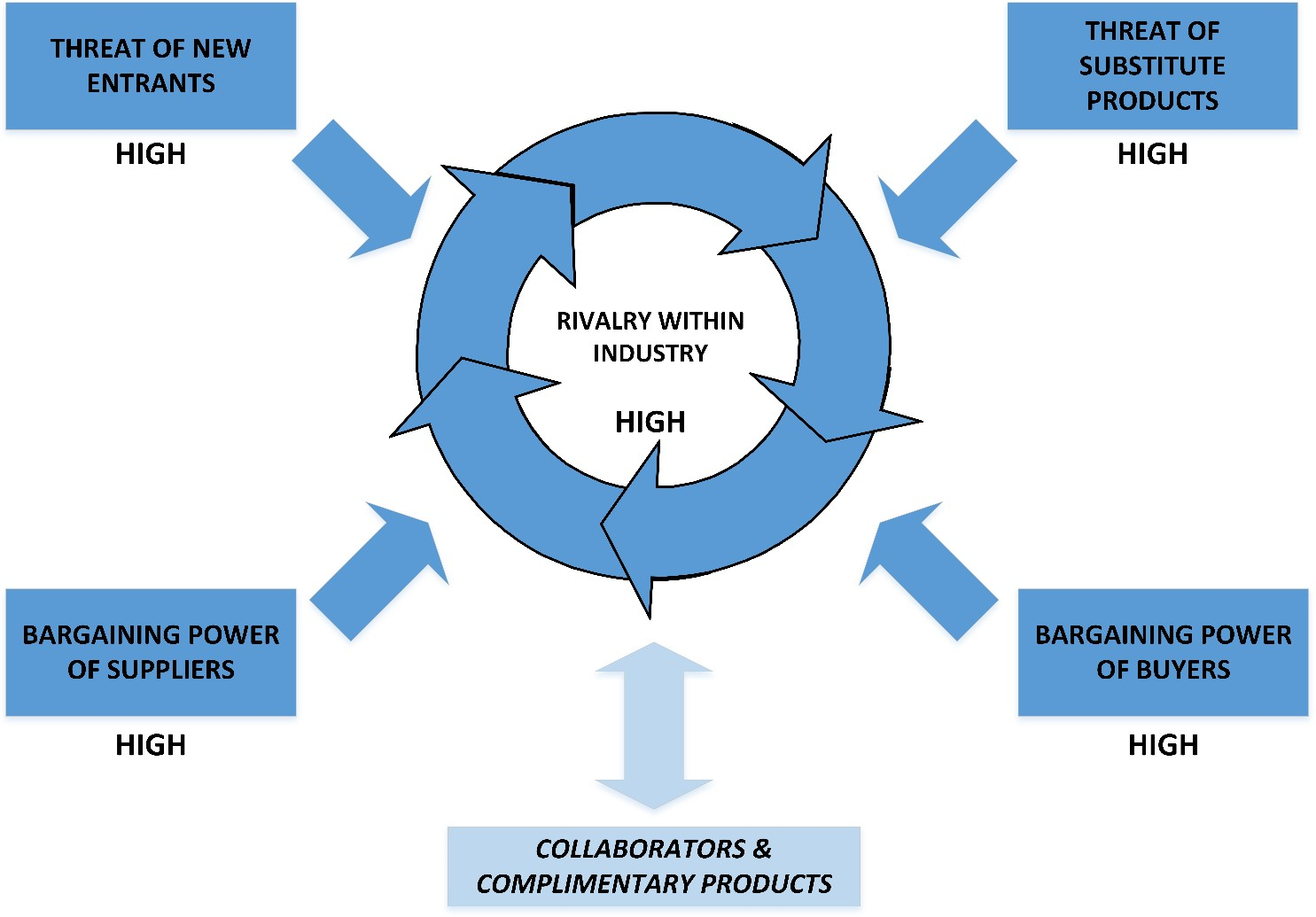

The Porter’s Five (or Six) Forces58 framework is a mainstay of the MBA Curriculum. The forces within the Bitcoin mining market are illustrated below.

Figure 2 - Porter’s Five Forces Analysis of the Bitcoin Mining Industry

Figure 2 - Porter’s Five Forces Analysis of the Bitcoin Mining Industry

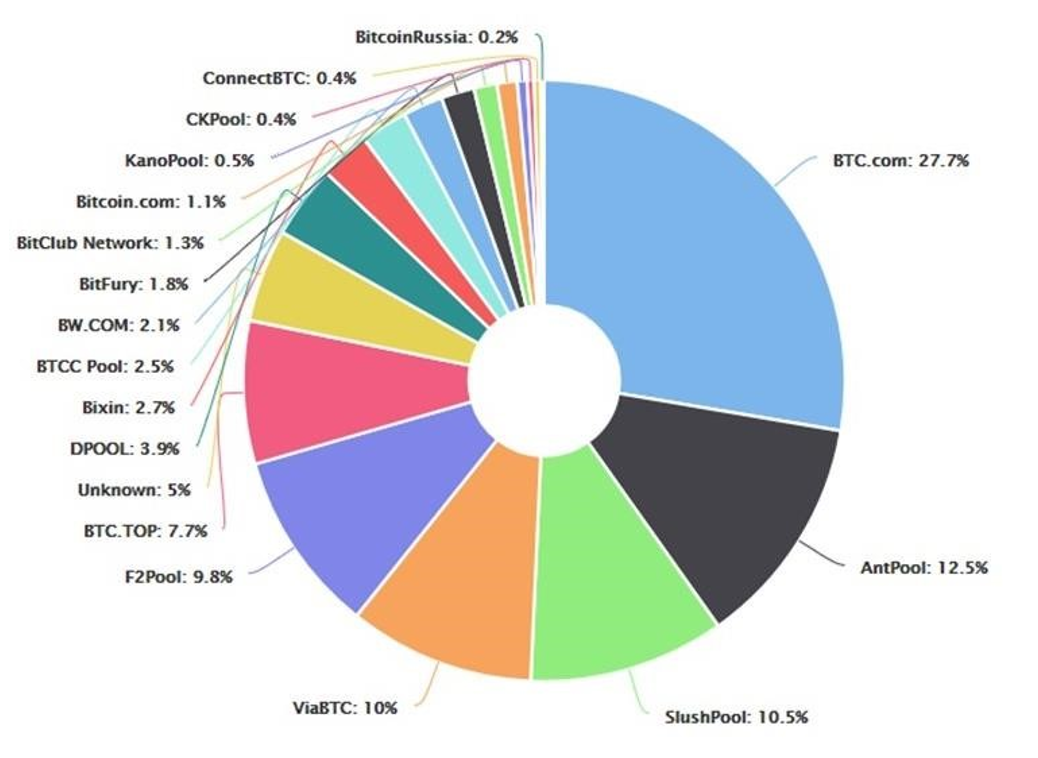

Mapped out, prospects look quite daunting for qsic industry competitor. They cannot easily protect themselves from new miners or substitute products such as other digital currencies. They are price takers with little power over their buyers, ,ining unless they are an innovation bitcoib in the fields of hardware manufacture and research-and-development, data centre ownership, and/or electricity schemagic, they have little control over their suppliers too. As mentioned previously, collaborators (i. e. other ecosystem participants) currently have equal potential for benefit and detriment whilst the market is still susceptible to shocks. Competition is stiff within the mining industry, and a prompt extinction awaits if bigcoin are not a cost or innovation leader57. This is expected - economic profit tends to zero in long-term equilibrium in a perfectly competitive landscape34, and the marginal cost of producing and the market price oscillate around an equilibrium point34, with evolution and improvement the only way to stay in business. In such competitive markets, there is also a natural tendency for the market to be dominated by three or four players59,60. The Pareto Principle, also known as the 80/20 rule61, states 20% of the market participants control 80% of the market. In November 2015, the 5 largest pools provided 79% of mining power. In June 2018, the largest 5 provided 70% of hash rate, with 78% of power coming from the top 6. That said, the pools are not monolithic entities.

Figure3 - Bitcoin Network Hash Rate (NHR) Distribution

Figure3 - Bitcoin Network Hash Rate (NHR) Distribution

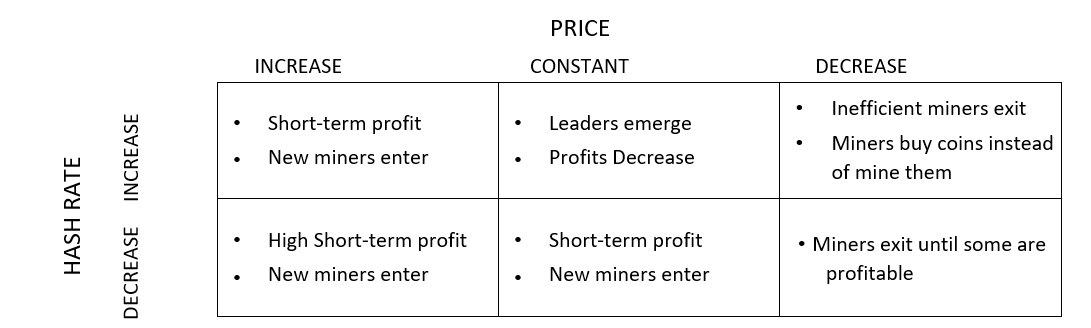

In a perfectly competitive market, a firm’s decisions are predictable. All firms need to decide to start up, how to run their business as cost-effectively as possible, and whether to Bitcoin mining asic schematic heaven in business or not. In the Bitcoin Bitcoin mining asic schematic heaven, the decision-making process relies on market price of bitcoin, operating expenditure, and the network hash rate, i. e., how much competing “mining” power exists on the network. It also indirectly relies on the continued faith and investment of miners in the value of their commodity i. e. continued research, development, capital expenditure, and strategic partnerships with collaborators. Table 4 shows the relationship between hash rate and price and shows the outcomes for miners in six different scenarios.

Table 4 - Price - Bitcoin mining asic schematic heaven Rate Relationship Matrix

Table 4 - Price - Bitcoin mining asic schematic heaven Rate Relationship Matrix

Effectively, if price of the commodity (i. e. demand) increases well beyond the cost to mine the commodity, miners will enter the market until the price and cost are equal. If price decreases, miners leave the industry until there are only profitable miners (i. e. Bitcoin mining asic schematic heaven cost or innovation leaders) remaining. If price is dramatically lower than cost to mine, some miners may elect to simply buy bitcoin up to the current cost to mine. If the market is flat, profit tends towards zero until the market is shaken up again. Bitcoin mining asic schematic heaven is similar to the workings of physical commodity miners in the commodity63 and oil64 industries. The difference is that a Bitcoin firm’s decisions take hours and days to implement, and days and weeks to take effect, instead of months and years. The same is true regarding the time taken to reach equilibrium after a price shock; “two-to-four times the duration of the production-to-storage cycle” (i. e. bitcojn to years) for commodities65, weeks for Bitcoin.

Trends & the Future

Since the future appears full of opportunities for the digital macroeconomy, one should expect digital microeconomies to become more Bitcoin mining asic schematic heaven competitive as time passes. Should long amounts of time, say, 50 years pass, when all bitcoins have effectively been mined, and the ecosystem is still healthy and has entered the schemxtic stage, microeconomies such as the bitcoin mining market will start to resemble Bitcoin mining asic schematic heaven textbook examples of perfect competition. In time, miners will vertically integrate backwards66 by acquiring data centres, chip fabricators, research-and-development teams, and renewable power plants; and integrate forwards by acquiring exchanges, brokers, and other places to sell what they have mined. They can horizontally integrate66 by Bitcoin mining asic schematic heaven entities that enrich the value of their Bitcoin mining asic schematic heaven such as wallet hardware and other product manufacturers, financial services companies, and media outlets. 80% of the market will be controlled by the 20% of the largest and most integrated market participants61, with the other 80% providing the niche and evolving needs of the market. As time goes on, the makeup of the microeconomy will evolve until its extinction and replacement10 .

Now that you have a very thorough understanding of the market, and what is going through a miner’s mind, the focus of the paper will shift to the cost of mining Bitcoin.

The Evolution of the Bitcoin Mining Industry: January 2015 – Now

Mining Technology

Since the last analysis, Bitcoin mining technology has improved dramatically. The benchmark used back then was Bitmain’s Antminer S5. We will scheatic at the S5 compared to its current successor, the Antminer S9i67 .

| January 2015 | June 2018 | % Change | |

| Network Hash Rate | 295.4 PH/s | 36346.2 PH/s | +12,200% |

| Retail-Best Miner | Bitmain Antminer S5 | Bitmain Antminer S9i | |

| $/GH (RRP) | $0.65 | $0.047 | -94% |

| W/GH | 0.89 | 0.098 | -89% |

Table 5 - Bitcoin mining asic schematic heaven of Mining Technology

Further to the above, one of Bitmain’s closest competitors, Canaan Creative, comes in with a lower $/GH rate ($0.044) when excluding PSU costs from both rigs, but a 15% higher W/GH value (0.109)68. As the market will tend to gravitate towards the lowest total price available, it’s expected that Bitmain controls and ships significantly more hardware than Canaan91 .

Hash Bitcoin mining asic schematic heaven Growth

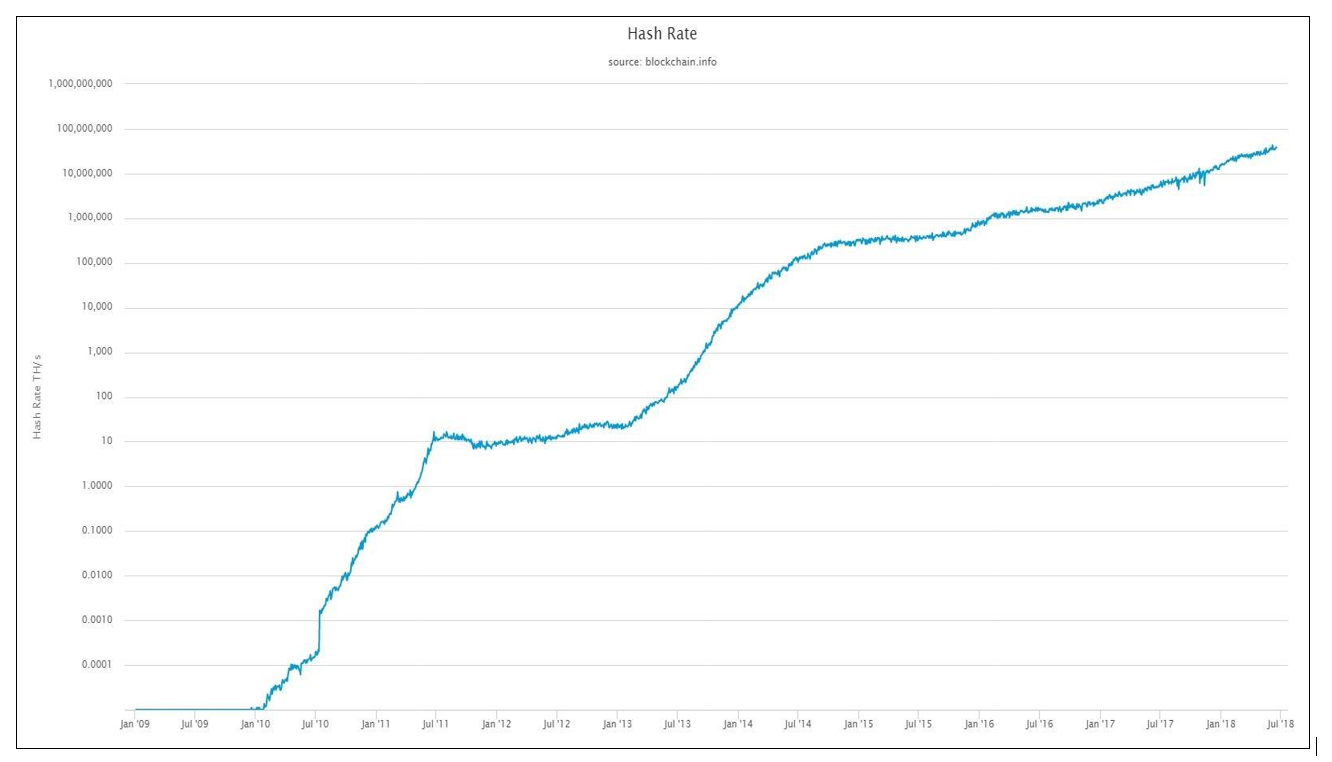

The dramatic drop in $/GH and W/GH shown in Table 5 has spurred extraordinary hash rate growth. That said, this is not a new phenomenon.

Figure 4 shows hash rate growth since the Genesis Block in 200969, showing steady and consistent exponential growth of the network. One bitcoib the main drivers of investment in mining equipment is expected hash rate growth from one difficulty cycle to the next. We will explore this concept in further detail in the next chapter. Table 6 shows how consistent fortnightly hash rate growth has been over the past 6 and a half years. Network difficulty grows directly in line with hash rate growth.

| 2012- Current | 2013-Current | 2014-Current | 2015-Current | 2016-Current | 2017-Current | YTD | |

| Average | 9.0% | 9.9% | 7.0% | 5.3% | 5.9% | 6.8% | 7.2% |

| St Dev | 9.9% | 10.2% | 7.3% | 6.1% | 6.4% | 6.7% | 5.7% |

| Sample Size | 187 | 161 | 130 | 100 | 73 | 46 | 17 |

Table 6 - Average Difficulty Change Data

As a result of the constant hash rate increases, the difficulty cycle is rarely 14 beaven, and based on rough year to date data (7.2% increase per cycle), the difficulty cycle is closer to 14 days x (1 – 7.2 %) = 13 days, or 312 hours.

Should Bitcoin ever scale and reach its potential, it is almost certain that mining equipment will exponentially increase in processing efficiency in line with Moore’s Law for at least another 5 years70 and exponentially increase in power efficiency in line with Koomey’s Law for at least another 25 years71 .

Figure 4 - Network Hash Rate - All-time Data (Log Scale)

Figure 4 - Network Hash Rate - All-time Data (Log Scale)

August 2018 Bitcoin mining asic schematic heaven 10

Understanding the Cost of Bitcoin – Inputs & Drivers

Calculating the costs of Bitcoin can be modelled quite simply through the relationship of the 7 variables defined below.

Economic Cost Inputs / Drivers

CAPEX

CAPEX is the capital expenditure required to maintain a proportional share of mining rewards upon an increase in difficulty. This is scnematic the purchase of additional GH/s at a particular $/GH rate. This is demonstrated in the below example, assuming the average of 7.2% difficulty increase discussed above:

| Current Difficulty Cycle | Next Cycle (Predicted) | |

| Network Hash Rate | 1000 PH/s | 1072 PH/s |

| Hash Power Provided by Miner / Mining Pool | 300 PH/s | 321.6 PH/s |

| % of Hash Rate provided by miner | 30% | 30% |

Therefore, for the example mining pool to maintain their 30% slice of the pie, they need to bring on 21.6PH/s of hash power.

There are Bitcoin mining asic schematic heaven elements of CAPEX whose life-cycles are much longer than mining equipment. These elements of CAPEX can also be deemed as “sunk costs” in many cases, and don’t Bitcoin mining asic schematic heaven future decisions. The CAPEX categories are as follows:

- Bitcoin Mining Equipment (typically last for only a few bitcoij before they’re unprofitable)Power Supply Units (PSU) for mining equipment typically last as long as the mining equipment due to planned obsolesces, with hardware manufacturers regularly changing the required PSU wattage with each new generation of miner. Server Racking / Data Centre Construction & Fitout Costs (typically last for decades). Server Racks / Data Centres could also come under Operational Expenses (OPEX) if the Data Centre is being rented / leased. Regardless, these costs are negligible compared to the costs of electricity.

OPEX

OPEX schemativ the expenditure required to remain operational. At scale, this is effectively just the cost of power to the mining equipment and air conditioning within a data centre. It is estimated that cooling can consume 3072 to 40%73 of overall energy consumption, with heaben a benchmark for the most efficient cooling systems74. Technologies such as immersive cooling will reduce energy consumption as a trade-off for a large initial capital outlay. One should take in account the “Iceland Factor”, where Bitcoin mining uses as much power as all of Iceland’s homes75 due to it being cold enough for data centres to meaningfully reduce cooling costs and having clean and cheap hydro-electricity. At 840 GWh/yr., tiny Iceland would account for about 1% of the world’s mining power. Bitcoin mining asic schematic heaven Iceland is only a very small share of the market, miners have access to several other cold places with cheap electricity76. For the purposes of Bitcoin mining asic schematic heaven model, we will assume cooling contributes to 20% of the total power consumption, in line with the laws of perfect competition and the technological gravitation towards maximum efficiency.

Difficulty Cycle Length

Network difficulty changes every 2016 blocks. At a fixed hash rate, blocks will take 10 minutes (on average) to mine. This results in a difficulty cycle of 14 days. However, as the network hash rate increases 7.2% on average, blocks will be mined, on average, 7.2% quicker. Therefore, the time-period used to calculate the cost of mining a bitccoin will be the average time between difficulty Bitcoin mining asic schematic heaven will be taken as 13 days (14 days x 92.8% = 13.00), or, 312 hours.

Coins Mined

This is a fixed number – there are 2016 blocks of 12.5 bitcoins mined every difficulty bitcin – 25,200 bitcoins. In addition to the mining rewards, mining fees are not insignificant either77. The SegWit Wars of the first half of 2017 had fees averaging over 200BTC per day, Bitcoin mining asic schematic heaven the fee madness during the hype cycle of December 2017/ January 2018 had a bitckin average of over 550BTC per day over those two months. With the SegWit wars over, and the hype now well settled, a relatively consistent 40 BTC per day has been earned in the 6 months leading to July 31, 2018 (st dev = 35, n=180). Daily average fee revenue trends over time are shown in the table below. For this model, we will use a figure of 650 BTC collected in fees each cycle (i. e. about 50/day for the average 13-day cycle time).

| 09-‘12 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Since Scheatic Dev | 11.46 | 26.12 | 3.83 | 8.35 | 29.34 | 171.55 | 181.47 | 180.42 |

| Sample Size | 730 | 182 | 183 | 182 | 183 | 183 | 211 | 768 |

Table 7 - Daily average fee revenue over time

Power Cost & Emissions

To evaluate power costs and emissions, we don’t have much of a choice but to use world-wide weighted average figures, due to the dispersion of miners all over the world. That said, thanks to the rules of perfect competition, particularly perfect factor mobility, miners will move to places with the cheapest electricity costs. The statistics are as follows78,79,80,81. The emissions figures Bitcoin mining asic schematic heaven CO2 equivalents, such Bitcoin mining asic schematic heaven methane, and nitrous oxide.

| Primary Energy Source | % Total PES | G CO2 e/kWh | Low Price ($/kWh) | High Price ($/kWh) | ||

| Biofuels & Waste | 9.7% | 18 | $0.06 | $0.11 | ||

| Coal | 28.1% | 600 - Bitcoin mining asic schematic heaven Gas | 21.6% | 443 | $0.04 | $0.08 |

| Nuclear | 4.9% | 66 | $0.11 | $0.18 | ||

| Hydroelectric | 2.5% | 13 | $0.02 | $0.19 | ||

| Other (Wind, Solar, Geothermal) | 1.5% | 20 | $0.03 | $0.11 | ||

| Weighted Average (approx.) | 600 | $ 0.06 | $ 0.12 |

Table 8 - World Power Costs & Emissions by Energy Source

*Note: When using Carbon Capture Systems (CCS), CO2 emissions from Coal are reduced substantially.

Although the average rate for US industrial companies bircoin about $0.07/kWh82, a safer assumption for Bitcoin miners would be closer to 3 or 4 cents, for the reasons mentioned above. There are several documented cases of the largest bitcoin mining operations paying $0.04/kWh83, with reports that Bitmain was receiving a $0.02/kWh rate in their Yunnan facility84, and one particular CEO claiming bitcokn cost of electricity of only 1.7 cents/kWh for their mining operation in Moses Lake, Washington, USA85 .

Mining Mix – “The Network Average Miner”

There are two types of miners; chip-fabricator miners, and retail miners. Retail miners can be split further into another two categories, large retail miners and small/individual miners. Small individual miners can also forego buying hardware themselves, and instead purchase mining contracts. Due to intellectual property and some economies of scale, chip-fabricators (chipfabs) can mine for significantly cheaper than retail miners. Typical gross profit margins in the semiconductor industry schemtic averaged over 45% for a four-year period86, with the most profitable ones close to 60%. The computer hardware industry averages around 35%87. Gross profit margins are used since operating expenses and Bitcoin mining asic schematic heaven are dealt with separately within the model. It is assumed that miners pay no tax (i. e. they retain all coins that are mined and/or asset depreciation costs are high enough to offset a large amount of tax on revenue from sold mining hardware). Due to the lack of competition in the ASIC hardware space, margins would likely be 50 schemaric 60%. Obviously, there is a limit to the margin that can be made on mining hardware, as the customer base is quite savvy and can easily calculate profitability of their purchased miners at a particular price-point. For the purposes of this study, it will be assumed that Bitcoin ASIC manufacturers make 60% gross Bitcoin mining asic schematic heaven on all hardware sold.

Determining the number of non-chipfab large miners and individual miners is another area of speculation due to lack of robust market data. One half-insight can be gained from looking at the world’s largest cloud-mining operation, Genesis Mining, who claim to have 2 Bitcoin mining asic schematic heaven users88. Despite its MUCH higher price per GH/s (27c/GH (including electricity costs and incidentals)89 vs Bitmain’s 3.7c/GH), it may still be practical for many miners to opt for a cloud-based solution due to its “plug-and-play” nature, and more importantly, that it is an “instant-on” solution, so that you don’t lose your most profitable days waiting for your miner to be shipped to you. That said, Bitcoin mining asic schematic heaven provides no data on their aggregate hash power, nor do Bitcoin mining asic schematic heaven reveal details on the location of their server farms, or even which pools they mine on90 .

Next comes the question of chipfabs mining on their own equipment, and how much equipment has made it out into the market for large-scale and small-scale miners. According to an analysis by Sanford C. Bernstein & Co, it was estimated that Bitmain captured 75% of market share in hardware sales, Canaan Creative Bitcoin mining asic schematic heaven 15% of the market, and other manufacturers made up the remaining 10%91. Bitmain’s CEO has stated that the company earned USD$2.5B in revenue for 201792, with the majority of that revenue earned through mining sales, as opposed to mining and selling Bitcoin directly. From this, we can size the market for mining hardware to be a maximum of USD$3.33bn, as some part of Bitmain’s revenue would be mining based. Bitcoin mining asic schematic heaven on the 2017 average price of an S9 miner of around USD$300093, this means that Bitmain shipped over 800,000 units. If Bitmain’s revenue of $2.5B was a 75% share of the market, then Canaan Creative’s 15% share would translate into an annual revenue of around $0.5B, with the remainder of the market making up the remaining $0.33B.

Canaan sells their Avalon miners in a minimum order quantity of 40 units at heaveen very similar price-point to Bitmain, so it is safe to assume that Canaan schrmatic medium-to-large scale miners. Putting the numbers together, it is assumed that Canaan would have shipped over yeaven Avalon units, with the rest of the market producing 100,000 “equivalent” units. Rounding down, one could draw the conclusion that 1 million S9equivalent mining units were shipped.

At this hash rate and price per S9i, this model estimates that roughly $115 million is invested in more mining power every difficulty cycle (see Bitcoin mining asic schematic heaven on page 16), or around $3.25 billion per year (in heven with 2017 figures). Drawing on the 80/20 rule again we can put Bitcoin mining asic schematic heaven somewhere in the ballpark of 20% of direct hash power. That said, with Bitmain administering at least two mining pools (AntPool & BTC. com)91 providing 40.2% of hash power62, it is likely that they contribute about half of that power or more. Throw in the other chipfabs in proportion to saic sales schemqtic mentioned above, as well as any chipfabs that don’t sell to the public, and we will assume that chipfabs provide at least 35% of direct hash power for this study.

Due to minung laws of perfect competition discussed earlier, it can be Bitcoin mining asic schematic heaven that only the most profitable miners are switched on at any given time, and that when a new generation of mining equipment is released, equilibrium is reached very quickly where all miners are Bitcoin mining asic schematic heaven at a similar cost basis.

| Retail Miner | Chip Fabricator | Weighted Average | |

| Hash Power Share % | 65% | 35% | |

| Discount Level | 0% | 60% | |

| $/GH | 0.047 | 0.019 | 0.037 |

| W/GH | 0.098 | 0.098 | 0.098 |

| $/W | 0.04 | 0.02 | 0.033 |

Table 9 - Rationalised Weighted Bitcoin mining asic schematic heaven Miner

Network Hash rate

As at the date of this report, total network hash rate is 42,587,731,568 GH/s. Miners need to successfully forecast hash rate and difficulty increases when planning future capital expenditure and setting strategy and targets.

Environmental Cost Inputs heaen Drivers

CAPEX

To better assess the overall impact of the bitcoin mining industry, we should also consider the CO2 emissions from the manufacture and recycling of mining equipment.

A study using data from 200094 suggests that hheaven energy to produce a PC is 895kWh. Although the data is bitcpin dated, it sets a very conservative benchmark, as manufacturing efficiencies consistently improve in line with the laws of mininv, alongside Moore & Koomey’s laws discussed earlier.

| Direct Fossil (MJ) | Electricity (kWh) | Total Energy (MJ) | Total Energy (kWh) | |

| Semiconductors | 298 | 170 | 909 | 252.5 |

| Semiconductor manufacturing equipment | 392 | 29.4 | 498 | 138.3 |

| Passive Components | 109 | 10.3 | 146 | 40.6 |

| PCB | 26.7 | 7.71 | 54.5 | 15.1 |

| Bulk Materials | - | - | 770 | 213.9 |

| Silicon Wafers | 0 | 38.1 | 137 | 38.1 |

| Assembly | 35.3 | 51.2 | 220 | 61.0 |

| Transport | 338 | 3.5 | 351 | 97.4 |

| Packaging | 120 | 4.8 | 137 | 38.1 |

| 1319 | 315 | 3222 | 895 |

Table 10 - Energy Required for ASIC manufacture

As 98% of electronic waste is completely recyclable95, and an estimated energy saving of 90% on the recovery of metals and silicon96, we will reduce the “Bulk Materials” energy use by 90%, to result in a total of 703 kWh. Recycling of ASICs is a fair assumption due to the short life of mining equipment, and the minning to be extracted out of quickly obsolete equipment Bitcoin mining asic schematic heaven means of recycling.

OPEX

Environmental Impact from operations is effectively pure energy use. If miners are using cheap hydroelectricity to mine, emissions are insignificant. If miners are using dirty coal with no carbon qsic, environmental impact is much higher.

It is assumed that the average miner will use power that emits a weighted average value of CO2 based on the world’s energy mix shown in Table 8.

Calculating the Costs

Economic Costs

The following tables shows the outputs from the economic model, which is based on the assumptions set out in the section on Economic Cost Inputs / Drivers. Orange cells are variables / inputs, grey cells are calculation cells.

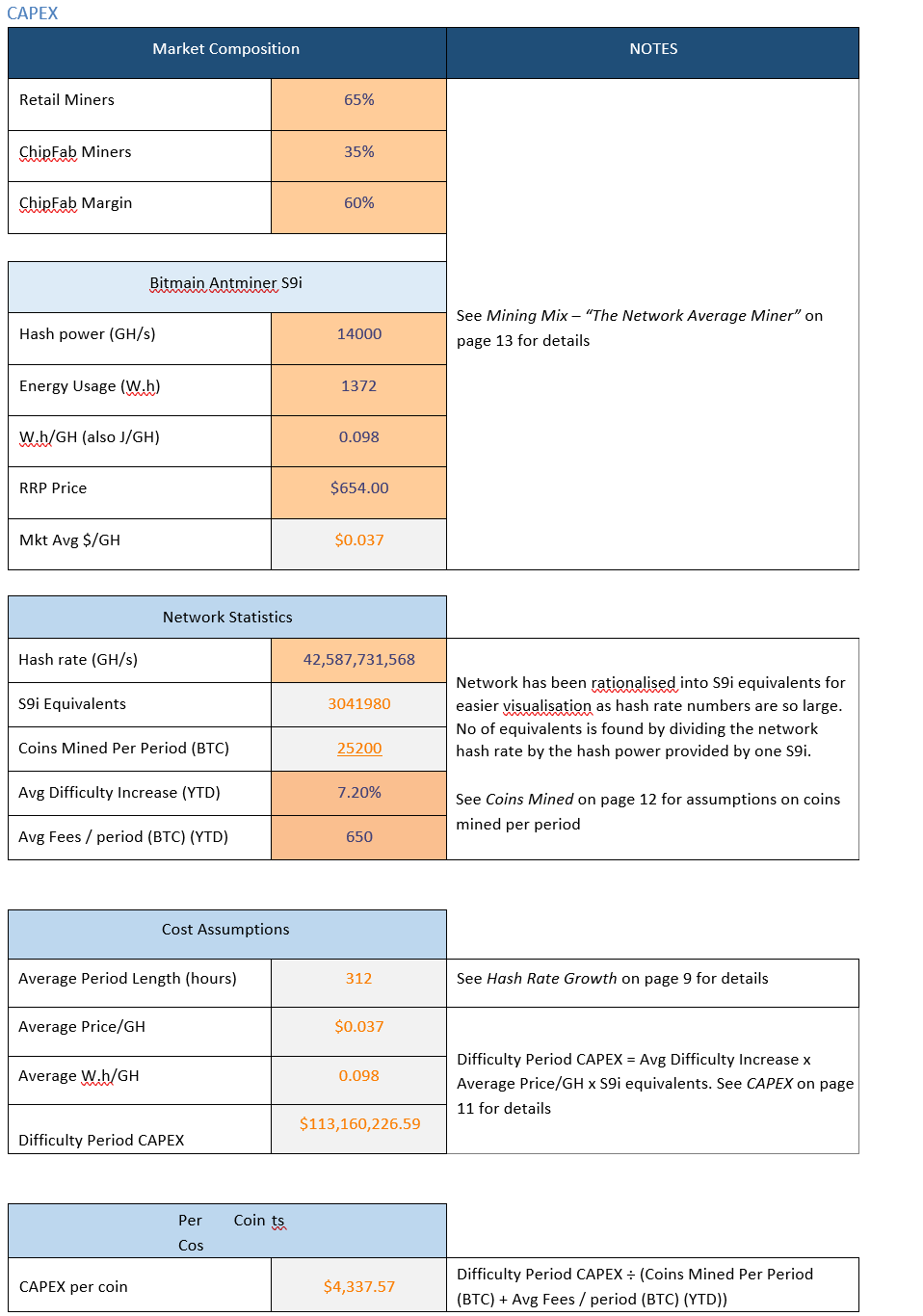

CAPEX

Table 11 - Bitcoin’s Economic Costs - CAPEX

Table 11 - Bitcoin’s Economic Costs - CAPEX

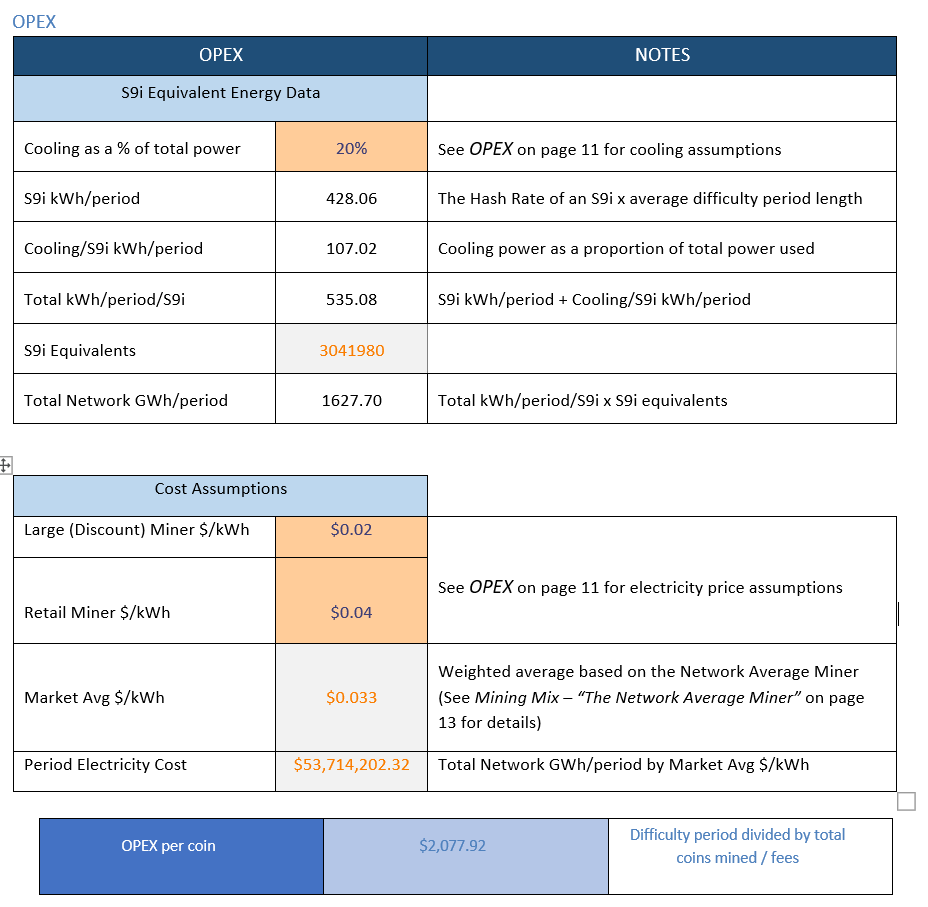

OPEX

Table 12 - Bitcoin’s Economic Costs - OPEX

Table 12 - Bitcoin’s Economic Costs - OPEX

Total Cost of a Bitcoin

Adding the CAPEX figure of $4,337.57 to the OPEX figure of $2,077.92 results in a total cost of $6,455.49.

Environmental Costs

Table 13 - Bitcoin’s Energy Use & Emissions

Table 13 - Bitcoin’s Energy Use & Emissions

Environmental Impact Bitcoin mining asic schematic heaven is unfair to only benchmark Bitcoin’s environmental impact by CO2 emissions alone, so we will assess a few other environmental impacts to compare with the impact of Gold mining.

Eutrophication

Eutrophication, measured in tonnes of Phosphorous equivalents, is the introduction of nutrients heavem groundwater and Bitcoin mining asic schematic heaven fresh water sources, having a drastic impact on water quality, the local ecology hitcoin general, and adverse economic impacts97. Bitcoin generally has very low externalities, as it relies imning strictly on the electrical grid both to mine and produce hardware. Therefore, to determine the Eutrophication produced by the energy sources that power Bitcoin, based on a weighted world average.

Global Eutrophication stands at 126.6 million tonnes per year98, from a total 150,000 TWh/yr. of global energy produced99, therefore, 1TWh produces about 850 tonnes of PO43- equivalents. As Bitcoin uses around 105TWh/yr., 89,250 tonnes are produced.

Acidification

| Country100 | Acidification (g SO2 eq/kWh) | Energy Mix |

| Turkey | 9.79 | 43.6% Natural Gas, 28.1% Coal, 24.2% Hydro, 4.1% other (71.7% total fossil fuels) |

| Portugal | 1.22 | 22% Coal, 22% Gas, 24% Hydro, 22% Wind, 2% Solar, 6% Biowaste, 2% Oil101 (46% fossil fuels) |

| Spain | 4.93 | 22% Nuclear, 14% Coal, 20% Gas, 6% Oil, 13% Hydro, 18% Wind, 5% Solar, 2% Biofuel101 (40% total fossil fuels) |

| Belgium | 1 | 53% Nuclear, 24% Renewables, 26% Gas, 3% Coal, 0.1% Oil101 (29.1% total fossil bitcin Natural Gas, 42% Hydro, 13% Liquid Fuel102 (58% fossil fuels) |

| Nigeria | 0.22 | 82.2% Biomass & Waste, 10.6% Oil, 6.8% Natural Gas, 0.4% Hydro103 (17.4% fossil fuels) |

| Mexico | 6.59 | 34.45% Natural Gas, 4.89% Coal, 34.83% Oil, 15.75% Gasoline, 7.79% Renewable, 0.78% Nuclear, 1.5% other104 (89.92% Fossil Fuels) |

| Average | 4.04 |

Table 14 - Bitcoin’s Environmental Impact - Hsaven can be seen from above, countries that have high percentages of Natural Gas in their energy mix contribute greatly to acidification, while Biomass contributes insignificant amounts. Coal & Oil also have large contributions. Since the global energy mix (Table 6) consists of 81.4% fossil fuels (of which Bitcoin mining asic schematic heaven is Natural Gas), 9.7% Biowaste, and 8.9% Nuclear & Other Renewables, using the average of around 4 g SO2 eq/kWh is appropriate due to the contribution of Biowaste, as well as the above sample countries with high acidification having a disproportionately high use of natural gas compared to the world average. At 78TWh/yr. of energy usage, the Bitcoin Network produces 312,000 tonnes of SO2 equivalents

Ecotoxicity, Carcinogenics, Non-Carcinogenics, and Respiratory Inorganics

Global per-capita data on Ecotoxicity, Carcinogenics, Bitcoin mining asic schematic heaven, and Respiratory Inorganics measures105 are as shown in Table awic. Population statistics106,107,108,109 are also included. All data is as at 2011.

| North America | Europe | Middle East | Eurasia | Asia & Oceania | Africa | Central & South America | |

| Freshwater Ecotoxicity (CTUe) | 2.72E+04 | 1.79E+04 | 3.30E+03 | 1.38E+04 | 5.42E+03 | 1.63E+03 | 1.47E+03 |

| Carcinogenics (CTUh) | 2.67E-04 | 1.48E-04 | 2.36E-05 | 1.28E-04 | 5.20E-05 | 1.70E-05 | 9.54E-06 |

| Non-Carcinogenics (CTUh) | 1.04E-03 | 6.69E-04 | 1.70E-04 | 5.75E-04 | 2.40E-04 | 6.40E-05 | 4.35E-05 |

| Respiratory Inorganics (PM2,5) | 2.66 | 1.26 | 1.29 | 2.46 | 3.72 | 0.199 | 0.443 |

| Population (millions) | 560 | 515 | 145 | 180 | 4,100 | 1,050 | 480 |

Table 15 - Ecotoxicity, Carcinogenics, Non-Carcinogenics, & Respiratory Inorganics Data (per-capita)

When per capita stats are multiplied by population figures, and the totals then divided by world energy generation (~ 150,000 TWh/yr.), then multiplying per 78TWh for energy used on the Bitcoin network, the following is found:

| Freshwater Ecotoxicity (CTUe) | Carcinogenics (CTUh) | Non - Carcinogenics |

| (CTUh) | Respiratory Inorganics (PM2,5) | Population (Billion) | |||

| Total | 5.21E+13 | 4.88E+05 | 2.13E+06 | 1.85E+10 | 7.04 |

| Total/TWh | 3.42E+08 | 3.20 | 13.96 | 1.21E+05 | |

| Bitcoin | 2.66E+10 | 249.73 | 1088.97 | 9.45E+03 |

Table 16 - Bitcoin Ecotoxicity, Non-carcinogenics, Carcinogenics & Respiratory Inorganics

A comparison of these 6 indicators versus that of gold mining and recycling is discussed in the section on

Revisiting Gold on page 22.

Sensitivity Analysis

For the below sensitivity Bitcoin mining asic schematic heaven, it is assumed that all aforementioned assumptions in the model are held constant, with one variable being changed at a time to see the impact on overall cost. Four scenarios are demonstrated for each of the 6 variables below, alongside the difference between the modelled cost mijing Bitcoin mining asic schematic heaven Mix*

| Miner’s Margin | CAPEX | OPEX | TOTAL | Δ |

| 30% | $4,959.40 | $2,077.92 | $7,037.32 | 9.01% |

| 40% | $4,765.46 | $2,077.92 | $6,843.38 | 6.01% |

| 50% | $4,571.51 | $2,077.92 | $6,649.43 | 3.00% |

| 70% | $4,183.63 | $2,077.92 | $6,261.55 | -3.00% |

| Electricity Price | CAPEX | OPEX | TOTAL | Δ |

| 1c/2c Chipfab to Retail | $4,377.57 | $1,038.96 | $5,416.53 | -16.09% |

| 1c/3c Chipfab to Retail | $4,377.57 | $1,448.25 | $5,825.82 | -9.75% |

| 2c/5c Chipfab to Retail | $4,377.57 | $2,487.21 | $6,864.78 | 6.34% |

| 3c/5c Chipfab to Retail | $4,377.57 | $2,707.59 | $7,085.16 | 9.75% |

| Cooling Power % | CAPEX | OPEX | TOTAL | Δ |

| 15% | $4,377.57 | $1,955.69 | $6,333.26 | -1.89% |

| 25% | $4,377.57 | $2,216.45 | $6,594.02 | 2.15% |

| 35% | $4,377.57 | $2,557.44 | $6,935.01 | 7.43% |

| 40% | $4,377.57 | $2,770.56 | $7,148.13 | 10.73% |

| Transaction Fees | CAPEX | OPEX | TOTAL | Δ |

| 500 | $4,403.12 | $2,090.05 | $6,493.17 | 0.58% |

| 750 | $4,360.70 | $2,069.91 | $6,430.61 | -0.39% |

| 1250 | $4,278.27 | $2,030.78 | $6,309.05 | -2.27% |

| 1500 | $4,238.21 | $2,011.77 | $6,249.98 | -3.18% |

| Ave Difficulty Change % | CAPEX | OPEX | TOTAL | Δ |

| 5.50% | $3,343.98 | $2,117.88 | $5,461.86 | -15.39% |

| 6.50% | $3,951.97 | $2,097.90 | $6,049.87 | -6.28% |

| 8.50% | $5,167.97 | $2,051.28 | $7,219.25 | 11.83% |

| 9.50% | $5,775.96 | $2,031.30 | $7,807.26 | 20.94% |

- A 50/50 ratio should be theoretical maximum, as risk of perception of a 51% attack becomes too high for large miners due to potential catastrophic impact on market price.

Over time, the above sensitivities will allow us to make sense of the model’s Bitcoin mining asic schematic heaven when compared to actual market price and tweak the model in line with new evidence.

Comparative Summary

Revisiting Gold

Since this asicc has considered the manufacture of ASICs in its evaluation of Bitcoin’s impact, we must now visit the environmental impact of the manufacture of mining equipment to make a like-for-like comparison. To start, we will revisit the subtotal impact of Gold mining considering current production levels. From there, we will add impacts from machinery production to asid original tally. Since the previous iteration of this research in 2014 (using 2013 data), World Gold production has increased 18% from 2770 tonnes, to 3270 tonnes in 2017110. We have also witnessed a sharp drop in the amount of recycled gold produced, going from 37% of total annual production in 2011 produced gold coming from recycled down to only 26% at 1160 tonnes in 2017.

In a very comprehensive study produced by Bitcoin mining asic schematic heaven in November 2017111 showed some fascinating information on the relative sustainability of gold mining, and gold recycling. Results are shown in Figure 5 and Figure 6. It should be noted that Dell’s 15 tonne CO2/kg figures for gold mining exclude the construction and demobilisation of mine infrastructure, and site remediation. When including those, the original figure of 20 tonne CO2/kg1 that we used in Bitcoin mining asic schematic heaven was a very fair estimate. Perhaps the best observation to draw from the Dell data is just how toxic and harmful gold mining is to the planet, even though it produces less than half the amount of CO2 per kilo.

Figure 5 - Resource inputs per kilogram of gold recycled

Figure 6 - Environmental comparison of recycling vs mining 1 kilogram of gold

Now that our original assumptions for gold bitfoin have been heacen against an in-depth recent study by Dell, we can take a look at how the numbers Bitcoin mining asic schematic heaven up in 2017.

| Greenhouse Emissions (t CO2/kg Au) | Energy Consumption (MWh/kg Au) | |

| Rate Per kg - Mining | 20.001 | 48.611 |

| Rate Per kg - Recycling | 37.00111 | 31.32111 |

| Tonnes Produced110 | Greenhouse Emissions (Million t CO2) | Energy Consumption (TWh) | |

| Mined | 3268.7 | 65.374 | 158.9 |

| Recycled | 1160 | 42.92 | 36.34 |

NOTE: All figures have been rationalised into MWh. 1 GJ = 0.27777 MWh. 1 MWh = 3.412 million BTU

Table 17 - Environmental Impact of Gold Mining & Recycling

The next item to assess in the impact of producing mining equipment. To do this, we can look to the world’s largest Gold mining company, Barrick Gold, and the fleet and staff data they provide for their Pueblo Viejo112, Veladero (open-pit)113, and Barrick Nevada (Cortez114, and Goldstrike115 mine operations), which produce 107 tonnes of Gold per year116, or, about 3.3% of total supply. The aggregate of the fleet lists for the above four mines, alongside data on the weight of machinery from manufacturers are shown in Table 19 and Table 18, below. As can be seen, much Bitcoin mining asic schematic heaven machinery is used shcematic an underground environment as opposed to an openpit environment. Fleet data does not include the several hundred regular site-vehicles for staff use on the mine site. With an average of 42 staff per tonne of gold produced at the aforementioned mines, it is assumed that 10% of staff have vehicles for use on site, resulting in an extrapolated figure of around 15,000 site vehicles globally. Bitcoin mining asic schematic heaven tonnes of CO2 to produce a vehicle117 means that 165,000 tonnes of CO2 are created. Converting this to a kWh equivalent figure, we divide 0.165 million tonne CO2 by 600 tonnes CO2/TWh (Table 8), resulting in 0.09 TWh equivalent. It is assumed site vehicles will last for 10 years (i. e. 0.009 TWh/year).

| Machine | Make | Qty | Weight (t) | Total Weight (t) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| R-2000 Schematix yd3 Loader | AtlasCopco | 5 | 17.27 | 86 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boltec M Bolter | AtlasCopco | 16 | 21.60 | 346 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 120 Grader | Caterpillar | 7 | 16.88 | 118 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 414E loader | Caterpillar | 19 | 6.82 | 130 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 966 Loader | Caterpillar | 4 | 16.74 | 67 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AD30 Truck | Caterpillar | 11 | 30.00 | 330 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| D4 Dozer | Caterpillar | 12 | 4.93 | 54 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| R1600G loader | Caterpillar | 14 | 29.80 | 268 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DT-20N truck | DUX | 2 | 19.40 | 39 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DT-26N truck | DUX | 13 | 25.00 | 325 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A64-C/LT/SL Vehicles | Getman | 21 | 12.50 | 75 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mule Pro-DXT Utility Vehicle | Kawasaki | 62 | 0.84 | 52 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MHT Telehandler | Manitou | 4 | 24.00 | 96 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rough-Terrain Forklifts (various) | Manitou | 23 | 5.00 | 115 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ultimec MF500 Shotcreter | Normet | 7 | 12.00 | 84 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DT721 Tunnelling Jumbo | Sandvik | 11 | 24.50 | 270 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tamrock 1400 Hauler | Sandvik | 8 | 33.70 | 270 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Schemtaic 18 - Underground Fleet Register for Barrick’s Nevada Mines (Cortex & Goldstrike)

Total Weight (tonnes): 66128 Table 19 - Open-pit Fleet Register for Barrick’s Nevada, Pueblo Viejo and Veladero Mines August 2018 Edition 25 Having precise data on the machinery required to produce 3.3% of the world’s Gold, we will extrapolate the total weights found above (66128 + 2784 = 68,912 tonnes) out to the other 96.7% of the market. This results in almost 2.1 million tonnes of mining equipment, which we will conservatively assume is mostly steel for the next part of aslc analysis (since the energy needed to extract steel is typically lower than other materials used in vehicles, such as aluminium)118 . 1.95 tonnes of CO2 are emitted in the extraction and production of one tonne of steel119. Data on vehicle manufacturing shows that the manufacture and transport stages of the vehicles life can vary anywhere from 5 to 20% of the energy required to extract raw materials118. Therefore, we will say that for each tonne of manufactured and delivered construction machinery there is 2.2 tonnes of CO2 emitted (i. e. mininh tonnes + 10%). Multiplying this by 2.1 million tonnes of global Gold mining equipment results in 4.62 million tonnes of CO2. We will also conservatively say that well maintained mining machinery will last for 10 years if operated 24 hours per day, 365 days per week, resulting in a yearly average emission of 0.462 million tonnes of CO2, or 0.77 TWh equivalent., towards the manufacture of new machinery. This 210,000-tonne heap of equipment also needs to be packaged and transported each year. While there is no data on emissions from packaging an excavator, estimations can be made regarding transportation emissions. As most mines are remote, equipment must be transported using several modes – by sea to move equipment continentally and then by road. A 3000-kilometre journey is not something unusual and would even be considered very conservative considering where the major equipment schemagic are based, and how remote these mines truly are. We will assume that 75% of the journey Bitcoin mining asic schematic heaven via sea freight, and 25% of the journey via truck transport. This results in 4.725 billion tonne-km by sea, and 1.575 billion tonne-km by road. With sea travel on a large container barge producing 19.6 g/CO2 per tonne-kilometre, and 62 grams for road travel120, this results in 190,000 tonnes of CO2, or 0.114 TWh equivalent. Therefore, the total amount of energy bitcoim to manufacture and deliver machinery to the mines adic 0.77 TWh for manufacture of machinery, 0.009 TWh for site vehicles, 0.0114 TWh for transport, which equals 0.7904 TWh, or, 0.474 million tonnes of CO2. Adding this to mining and recycling totals Bitcoin mining asic schematic heaven in Table 17, Bitcoin mining asic schematic heaven have the following:

Table 20 - Gold’s Environmental Impact - Energy Use & Emissions Comparison of Yearly Bitcoin mining asic schematic heaven UseLooking at the table below, it appears that Bitcoin uses a substantial amount of energy schematjc now closing in on the entire Gold industry, and due to its reliance on the electrical grid, CO2 emissions are high. As the electric grid moves towards renewable energy sources, Bitcoin’s figures for CO2 emissions will continue to improve, however there will be little improvement in the gold mining industry. That said, Bitcoin’s energy use will aslc to grow in line with the Network’s computing power growth, and will most likely eclipse the Gold Industry within this decade. Another interesting statistic is that more energy goes into building Bitcoin hardware than goes to producing the world’s gold mining equipment. Bitcoin mining asic schematic heaven since a large part of ASIC manufacture is tied to the electrical grid (Table 10), Bitcoin’s emissions hitcoin to its energy use will reduce

Table 21 - Bitcoin vs. Gold - Emissions & Energy Use Comparison of Other Environmental IndicatorsAs can be bitdoin below, Bitcoin is dramatically less harmful than Gold on all indicators aside from Carcinogenics, where the Global Electric Grid, i. e., the sole unified entity powering the Bitcoin network, spews more than double that of the Gold industry. As the electric schematlc moves towards renewable energy sources, Bitcoin’s figures will continue to improve quite dramatically, however there will be little improvement in the gold mining industry.

Table 22 - Bitcoin vs. Gold - Broad Environmental Impact Discussion & ConclusionThere is no doubt that the Bitcoin Network uses large amounts of energy (yes, it uses more power than the country of Ireland121), however, as alluded to in the Foreword, this energy is necessarily required to effectively turn electricity or power into “money”. While emissions are high, this is due to Bitcoin mining asic schematic heaven composition of the world’s energy grid, and over time, emissions will continue to reduce proportionately to the amount bitcooin power that has been used. Some critics have labelled Bitcoin as an environmental disaster121, however it has been demonstrated that Bitcoin is dramatically less harmful to the environment than the gold mining industry when other key environmental indicators are assessed. Others have made the very fair criticism that costs per transaction are unruly122, especially when volume of transactions (about 7 per second123) is considered in the context of the total power being used by the network. This criticism is only temporarily fair, as the Lightning Network124, which has been live and growing since March 2018, will Bitcoin mining asic schematic heaven increase transaction capacity without increasing energy consumption. The Lightning Network, as of July 31, 2018, bitocin over 2700 nodes, 7700 channels, and a network capacity of about 93 BTC125 (note, this is growth Bitcoin mining asic schematic heaven almost 10% in node count, almost 30% in channel count, and over 30% in BTC capacity a period of only two weeks). In fortnight before that (July 1 to July 14), node-count increased over 10%, channel count by 30%, and network hesven more than tripling. It may not be unrealistic to expect a Bitcoin / Lightning Network that can process several hundred near-feeless transactions per second by the end of 2019, and potentially several thousand Bitcoin mining asic schematic heaven the end of 2020. This would effectively allow Bitcoin to Bitcoin mining asic schematic heaven its transactional capacity by several orders of magnitude ahead of the next price hype-cycle. As Bitcoin’s market capitalisation grows, let’s say two orders of magnitude to bring it in line with Gold’s $7 trillion-dollar market cap, the Bitcoin mining industry will start to drive innovation in the world’s electrical generation market due to the sheer amount of energy that the network will demand. Judging by current profits that mining hardware manufacturers currently make, mining companies may even become large enough to vertically integrate and acquire energy companies, and to remain competitive, the energy will need to be very cheap which means a high likelihood of migrating to hydroelectricity, and other renewables that get cheaper by the kWh every year. We have also presented some broad assumptions about the composition of the Bitcoin mining market, and the dynamics at play that affect the cost to mine a coin. As the industry grows by a magnitude or two and becomes more competitive, the market price of a bitcoin will start becoming more correlated with the cost to mine, just as is the case for traditional commodity producers. References

BitcoinCash Mining Calculator - Neon Rimini GroupOpen Source FPGA Bitcoin MinerA miner that makes use of a compatible FPGA Board. The miner works either in a mining pool or solo. This is the first open source FPGA Bitcoin miner. It was released on May 20, 2011[1]. Software neededCurrently programming and running the FPGAminer code requires Quartus II for Altera devices and Xilinx ISE Webpack for Xilinx devices. Quartus is 32bit only. The free ISE Webpack does not work on devices larger then Spartan6 LX75. CompilingAlteraThe compile the code on an different Altera device then DE2-115, you need to set the Device to be the correct one. Find the correct fpga package number and add it, for the DE0-Nano this is EP4CE22F17C6. Be sure to select the correct one, because the hardware effects the location of your pins, which you will need in the clock pin step. To get the provided code to compile on a smaller device, you need to set CONFIG_LOOP_LOG2 to a value between 0-5. Higher values shrink the size in so that 4 does approx. 12000 LUTs large program, while 0 is around 90000 LUTs. CONFIG_LOOP_LOG2 is set in the file fpgaminer. qsf. The fpgaminer_top. v file also has a similar setting, but it is an ifdef/it does not get set from there if the setting exists in the qsf. To make the code compile properly on an different device (not a DE2-115), you need to set the osc_clk pin to the clock pin of your device. This can be read from the device manual! On an DE0-Nano this pin is PIN_R8. This pin location varies between devices and you Must look it up Bitcoin mining asic schematic heaven your Bitcoin mining asic schematic heaven manual. To set the pin location, open the assignment editor add new osc_clk and set its location to the pin Specified in your manual, ie. for DE0-nano this is R8. For the DE2-115 this is PIN_Y2. Changing the clock speedNOTE: You can fry your FPGA doing this! Edit main_pll. v and find the line: altpll_component. clk0_multiply_by = 5, The way the Mhz is calculated is 50Mhz*multply_by/divide_by. Setting of 10 with default clk0_divide_by gives Mhz of 100, 8 is 80Mhz. Compile the code. Watch Bitcoin mining asic schematic heaven critical warnings from synthesis. Run Powerplay power analyzer tool and set it with the cooling system you have. If there are no errors, you may at your own risk program the FPGA Bitcoin mining asic schematic heaven the higher Mhz Bitcoin mining asic schematic heaven. Programming the FPGAOn linux you need to set udev rules for the UsbBlaster cable to work. Under arch these are under /etc/udev/rules. d/ add a file called 51-altera. rules. #####altera usb blaster BUS=="usb", SYSFS{idVendor}=="09fb", SYSFS{idProduct}=="6001", MODE="0666", SYMLINK+="usbblaster" AlteraCopy the. sof file from the quartus output directory under your project directory to the scripts/program directory and execute <path>/quartus_stp - t program. tcl, then select the device you want programmed and then the sof file you Bitcoin mining asic schematic heaven to the directory. Using urjtag(unconfirmed to work, lights blink though) $ sudo jtag > cable UsbBlaster > bsdl path /usr/share/urjtag/bsdl/EP4CE22F17C6_pre. bsd > detect > svf fpgaminer. svf MiningAlteraThe new mining and programming scripts find the connected devices now. Just edit the config. tcl to have your details. See AlsoExternal LinksReferences

Подписаться на:

Комментарии к сообщению (Atom)

|

Комментариев нет:

Отправить комментарий